تحميل 1xbet اخر إصدار: نصائح لتثبيت التطبيق بشكل صحيح Seacom

29 de outubro de 2025

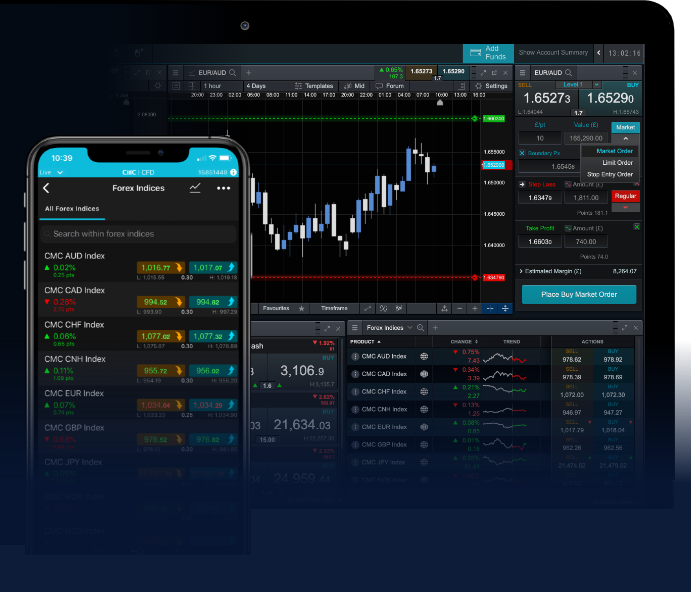

In the fast-paced world of Forex trading, success often hinges on timely and accurate decision-making. One tool that many traders utilize to aid in their strategies is the use of Forex trading signals. These signals can help traders identify potential entry and exit points in the market, thus increasing their chances of making profitable trades. For those looking to get started in Forex, it can be beneficial to find a reliable broker. Check out forex trading signals Best South African Brokers for recommendations on trusted trading platforms.

Forex trading signals are essentially indications of the right moments to buy or sell a currency pair in the Forex market. They can be generated by various sources, including professional traders, automated systems, and analytical tools. Understanding these signals and their implications is critical for both novice and experienced traders alike.

What Are Forex Trading Signals?

Forex trading signals are recommendations or indications that suggest when to enter or exit a trade based on specific analysis or algorithms. These signals are primarily communicated through various forms, including SMS, email, or trading platforms. They often encompass the following information:

- The currency pair to be traded (e.g., EUR/USD, GBP/JPY)

- The type of action to be taken (buy/sell)

- The expected price target

- Stop-loss levels to minimize risk

These signals are invaluable, as they can save traders from the complexities of market analysis and provide clear guidance on trading actions. However, the efficacy of these signals can vary significantly depending on their source and the strategies employed.

Types of Forex Signals

Forex signals can be classified into two main categories: manual and automated signals. Understanding the differences between them can help traders choose the best options for their trading style.

Manual Signals

Manual trading signals are generated by experienced traders or analysts who analyze market data and identify potential trading opportunities through technical or fundamental analysis. These signals often come with detailed explanations, allowing traders to understand the reasoning behind each recommendation. Manual signals are popular among traders who prefer a more hands-on approach and value personal insights.

Automated Signals

Automated trading signals are generated through algorithmic trading systems or trading robots that utilize historical data and predefined criteria to identify trading opportunities. These signals can be advantageous for traders who prefer a systematic approach or those who may not have the time to analyze markets consistently. However, it is essential to choose reputable services, as the quality of automated signals can vary widely.

How to Use Forex Trading Signals Effectively

To maximize the benefits of Forex trading signals, traders should consider several strategies:

1. Choose Reliable Sources

The quality of Forex signals can significantly impact your trading success; therefore, it is crucial to choose reputable sources. Many signal providers offer free trials, allowing traders to assess the performance of their signals before committing financially. Look for verified results and positive reviews from current users.

2. Understand the Market Conditions

Forex signals should not be used in isolation. It is essential for traders to have a basic understanding of market conditions and trends. Complementing signals with sound market analysis can lead to more informed trading decisions. Traders should also consider news events and economic indicators that might affect currency movements.

3. Implement Risk Management Strategies

No trading strategy is without risk, and therefore, it is crucial to implement strong risk management practices. Setting stop-loss orders as indicated in signals can help protect your account from significant losses. Additionally, traders should never risk more than a predetermined percentage of their trading capital on a single trade.

4. Keep a Trading Journal

Maintaining a trading journal can help traders track the performance of their signals and identify patterns over time. By documenting trades, traders can analyze what works and what doesn’t, leading to improved trading strategies going forward.

Benefits of Using Forex Trading Signals

While not every trader may directly benefit from using Forex trading signals, there are several advantages that can enhance a trader’s overall experience:

- Time-Saving: Signals save traders time by eliminating the need for in-depth analysis before making trades.

- Guidance for Inexperienced Traders: New traders can benefit from professional insights, helping them gain confidence in their trading decisions.

- Emotional Control: Following signals can help traders stick to a predetermined plan, reducing the risk of making impulsive decisions based on emotions.

Challenges and Considerations

Despite the numerous benefits, relying on Forex trading signals also comes with its challenges. Traders should be aware of:

- Signal Quality: Not all signals are created equal; traders must discern the quality and reliability of the source.

- Market Volatility: The Forex market can be unpredictable, and signals may not always align with rapid market changes.

- Over-reliance: Some traders may fall into the trap of becoming too reliant on signals, stunting their own growth and understanding of the market.

Conclusion

Forex trading signals can be a valuable tool for both novice and experienced traders looking to navigate the complexities of the Forex market. By understanding how these signals work, selecting reliable sources, and implementing effective trading strategies, traders can unlock their profit potential in the dynamic world of Forex trading. As you embark on your trading journey, remember to continuously educate yourself about market trends and practices, ensuring that your trading remains aligned with your financial goals.